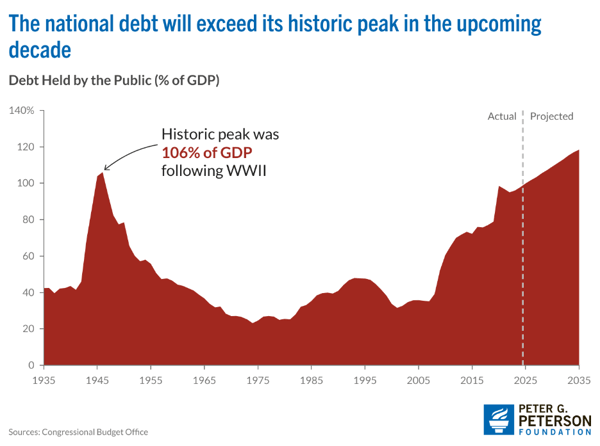

The U.S. national debt has passed the $37 trillion mark and keeps growing. Experts believe that current levels of spending aren't sustainable, pending aren't sustainable, and that we could be headed toward a new financial crisis. Is there a risk that the U.S. would default on its debt? What would happen in this scenario?

What Happens When a Country Defaults on Its Debt?

Countries such as Ecuador, Argentina, Venezuela and Greece have defaulted on their debt in recent history. This decision plunged Argentina into a period of instability before the debt was successfully restructured.

Countries like Russia, Spain and Germany have defaulted on their debt in the past and have successfully recovered. The effects of defaulting vary from one country to another. Inflation and high unemployment have affected countries like Greece and Argentina, and borrowing has become temporarily difficult and expensive for almost all countries mentioned.

The Total US National Debt and The Debt Ceiling

In 1933, the Second Liberty Bond Act established an early version of the debt ceiling. The purpose of the debt ceiling is to put a cap on how much the government can borrow. Only Congress can raise the debt ceiling.

The debt ceiling has increased 10 times over the past 10 years, including four times in 2008 and 2009. The "One Big Beautiful Bill Act" signed in July 2025 raised the U.S. debt ceiling by $5 trillion to $41.1 trillion. This represented an increase from the previous $36.1 trillion ceiling which had been reinstated in January 2025.

What would happen if Congress didn't raise the debt ceiling?

If the debt ceiling isn't raised, the U.S. could theoretically run out of money to pay back loans. However, there are other options the government would explore before defaulting. Government agencies could keep operating by borrowing money from retirement funds other than Social Security and Medicare.

The Federal Reserve Bank also has some funds that would be used in this scenario. Revenues from sources such as taxes would be used. The U.S. Treasury could also delay payments and issue notes with different terms.

It's likely that payments to federal employees and recipients of Social Security and Medicare would stop. Failing to raise the debt ceiling would have disastrous consequences on the economy. Demand for U.S. Treasury bond would significantly drop on the secondary market.

Yields would increase to make these bonds more attractive, which would result in higher interest rates for borrowing. Not raising the debt ceiling, delaying payments or changing payment terms would cause foreign investors to lose confidence in U.S. Treasury bonds.

This low demand could negatively impact the U.S. dollar.

Other Consequences of the Federal Debt

As the treasury keeps issuing more bonds, yields have to increase to make them appealing to investors. Because interest rates are tired to these yields, more bonds being issued means that the cost of borrowing will increase for consumers.

As the risks of a new financial crisis increase, investors will very likely lose confidence in the U.S. Treasury's ability to honor the bonds issued and might look for alternatives.

Take action

Reducing spending and increasing revenues should be priorities for the current administration. The U.S. Federal budget affects everyone. Up to Us Leadership Network offers three programs that enable college students to develop the advocacy, policy, and leadership skills necessary to effect meaningful change. Participating in any program unlocks access to the Network and its opportunities for career-focused connections, events, and resources. Students are invited to participate in multiple programs over the course of their undergraduate career.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nation’s fiscal future, or get involved by learning about how you can make a difference in your own community.