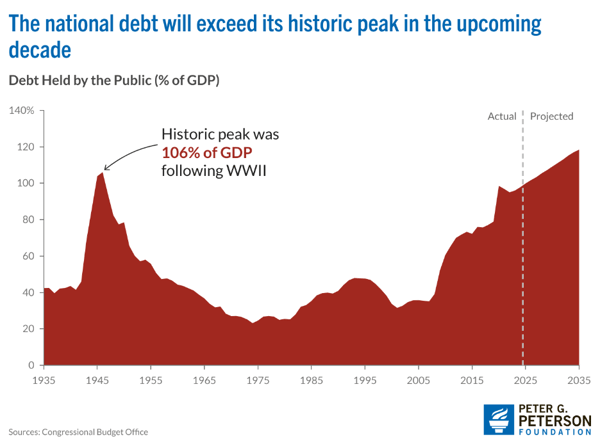

The national debt currently exceeds $37 trillion. In the 2020s, the U.S. has added debt at a rate of $1 trillion every 5 months, which is more than twice the rate that has prevailed over the past 25 years. The current level of spending is unsustainable, and experts agree that the current deficit will have disastrous consequences for the economy.

The US owes money to two groups:

-

The public

-

Intragovernmental holdings

How does the national debt work?

The government finances the operation of the different federal agencies by issuing treasuries. The Treasury Department oversees issuing enough savings bonds, Treasury bonds, and Treasury inflation-protected securities to finance the government's current budget.

Revenues generated by taxes are used to pay the bonds that come to maturity. Investors, including banks, foreign governments and individuals, can cash in on these bonds when they reach maturity. The debt ceiling is the cap that is set on what the Treasury Department can issue.

Congress keeps raising the debt ceiling to finance government spending. A deficit occurs when spending increases faster than revenues.

Who owns this debt?

The public owns 80 percent of the current national debt. Intragovernmental debt accounts for 20 percent or $7 trillion. The public includes foreign investors and foreign governments. These two groups account for 30 percent of the debt. Individual investors and banks represent 15 percent of the debt.

The Federal Reserve is holding 23 percent of the treasuries issued. The Federal Reserve has been purchasing these bonds to keep interest rates low after the 2008 Financial Crisis. States and local governments hold 9 percent of the debt.

Foreign governments who have purchased U.S. treasuries include China, Japan, Brazil, Ireland, the U.K. and others. Investors in Japan and China hold significant shares of U.S. public debt. As of December 2024, they together accounted for $1.8 trillion, or 6.3 percent of DHBP. Investing in U.S. treasuries is a deliberate strategy for foreign countries. China has been using these bonds to keep the Yuan weaker than the U.S. dollar and benefit from low import prices. Intragovernmental debt encompasses different funds and holdings.

Some agencies take in revenues and use this money to purchase treasury bonds. This makes the revenues usable by other agencies, and these bonds can be redeemed in the future when these funds and holdings need money.

What are the consequences of the current deficit level?

Borrowing at this rate is causing the cost of debt to increase. Securing additional funds is becoming increasingly difficult, and the government is faced with higher interest rates. Under CBO’s latest projections, by 2026, it is estimated that interest costs alone will reach 3.2 percent of gross domestic product (GDP), which would eclipse the previous high set in 1991. Interest costs would climb to 4.1 percent of GDP by 2035.

In August 2025, interest payments represent the third largest category in terms of government spending. Higher interest rates are creating a snowball effect that results in the debt growing at an increasingly faster pace. High interest rates are also affecting consumers who end up spending more on mortgages and other loans.

The national deficit will also impact economic growth and the private sector. A deficit means there are less funds available for projects that would dynamize the economy, such as financing construction projects to improve the country's infrastructure.

The government is also flooding financial markets with treasuries, which means the private sector will have an increasingly hard time with securing funds from investors.

What can you do about this issue? Take action!

There are currently no plans to reduce federal spending or increase revenues. This is an issue that will affect future generations and greatly reduce economic growth for the years to come.

Up to Us Leadership Network offers three programs that enable college students to develop the advocacy, policy, and leadership skills necessary to effect meaningful change. Participating in any program unlocks access to the Network and its opportunities for career-focused connections, events, and resources. Students are invited to participate in multiple programs over the course of their undergraduate career. Get involved by learning about how you can make a difference in your own community.