Rising debt will hurt our economic prospects and our ability to invest in the future.

What does the national debt have to do with your wallet? Quite a bit, actually.

An increasing national debt could cause an increase in the cost of borrowing for everyone, making mortgages and private business loans more expensive for individuals – making it harder for Americans to buy a home and find a good-paying job.

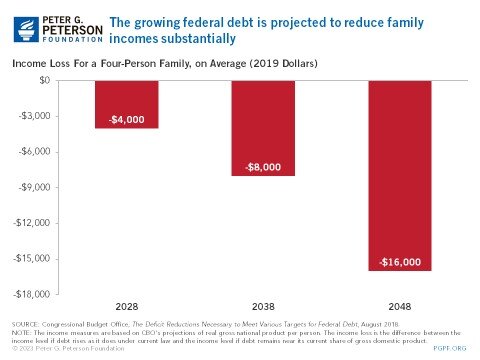

Even before the rapid growth in the federal debt due to legislation to mitigate the effects of the COVID-19 pandemic, the nonpartisan CBO anticipated that the debt's trajectory would reduce a four-person family's income by an average of $16,000 in 2048. While more recent estimates are not available, given the rapid growth in debt in the last couple of years, we can assume the situation is more daunting. That’s money that won’t be spent in the economy, or invested for vital priorities like education and retirement.

National Debt and Interest Costs

A soaring national debt will crowd out crucial investments in priorities like health, education, infrastructure, and innovation.

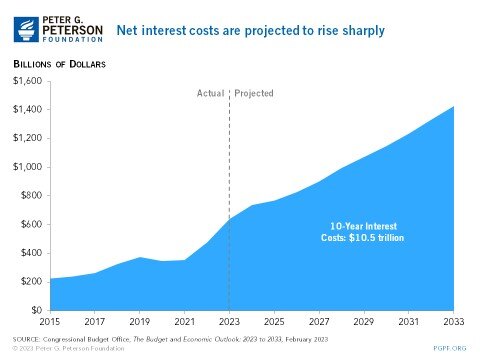

By 2053, interest costs are projected to be more than three times what the federal government has historically spent on average for R&D, infrastructure, and education combined.

In just over a decade, interest costs will become the third-largest category in the federal budget, trailing Social Security and Medicare. And by 2053, interest payments will cost more than three times what the government has typically spent on research and development, infrastructure, and education combined.

Who gets paid the interest on the national debt, anyway?

Debt held by the public, which excludes any debt owed to other U.S. government agencies, is money the U.S. Treasury has borrowed from outside lenders through financial markets. The interest on this debt is paid to individuals, businesses, pension and mutual funds, state and local governments, and foreign entities. Debt held by the public at the end of the 2022 fiscal year was $24.3 trillion - about one-third of this debt is held by foreign creditors.

So, what can you do?

It’s not complicated: Whether you’re passionate about healthcare, higher education, clean energy technology, or national defense, you have a vested interest in making sure we get our fiscal policy on a sustainable path.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nation’s fiscal future, or get involved by learning about how you can make a difference in your own community.