The budget for the fiscal year 2020 was based on these pillars: the safety and security of Americans, a stronger and healthier economy, enhanced quality of life, and a commitment to a better future. Creating the national budget for the fiscal year is a process that begins with the presidential budget. The federal budget for the 2020 fiscal year was set at $4.79 trillion.

What is the federal budget?

Each fiscal year the federal government creates a budget to allocate funding towards services and programs for the country. Congress created the budget process in 1974, but it has seldom been used due to disagreements, posturing, and inefficiencies within the government. To calculate the budget, the government must consider its allotted money and its expenditures. The money that goes into the budget comes from tax revenue and the sale of treasury securities. Expenditures include mandatory spending, discretionary spending, and debt interest.

Some of the programs and services that are funded by the federal budget include defense, transportation, unemployment and social welfare payments, and healthcare. The budget consists of how the government wants to collect and spend its money for the fiscal year, determining what programs and services will be consumed and invested in. The federal budget is active from October 1st to September 30th each year.

The congressional fiscal budgeting process

There are several steps that go into creating a budget. First, in March, departments and agencies submit proposals for their own programs and services that will later be considered as the president builds his own budget. The president passes this on to Congress who look at the budget independently (The House of Representatives and the Senate) and make adjustments and recommendations. This then goes to the Conference Committee. The House and the Senate then divide the discretionary budget to subcommittees who draft appropriation bills for agencies. Both the House and the Senate vote on their bills, and the separate versions are combined into one that is later voted on and sent to the president. The president needs to sign the federal budget by the end of September for the fiscal year to have a determined budget.

Congress created the national budget process and is largely responsible for its execution. First, the presidential budget for the following fiscal year is submitted to Congress on or before the first Monday of February. Congress typically responds with spending appropriation bills sent to the president by the end of June.

The president has 10 days to reply, and the final budget must be approved by the end of September. In February of this year, Congress ignored the president's budget and approved a two-year discretionary spending bill. Appropriation bills that outline spending by department will be released next year

Primary Spending Categories

The three primary national spending categories are mandatory spending, discretionary spending and interest on the total national debt. Here are some charts and information about the federal budget and national debt.

Federal Budget: Mandatory spending

Mandatory spending includes government-funded programs such as Medicare, Medicaid and Social Security. These are necessary programs, but they are not self-sustaining. Medicare is currently underfunded, relying on general tax dollars to make up the difference. Only a portion of the $625-billion Medicare budget is covered by Medicare taxes.

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

Mandatory spending helps provide for individuals who need help in some capacity, but it also reduces the amount the government can spend on discretionary programs.

Federal Budget: Discretionary spending

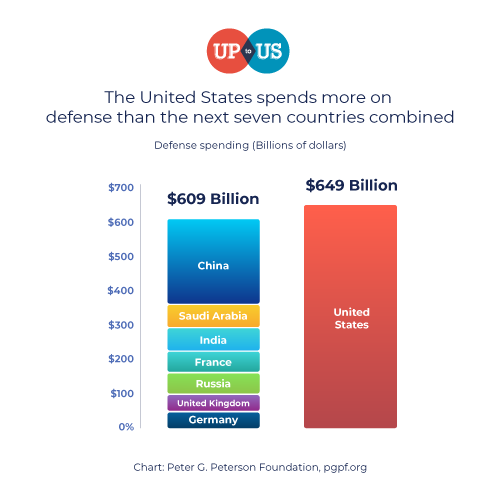

More than half of the $1.438 trillion discretionary spending budget is for defense-related departments, such as military spending and Veteran's Affairs. This also includes spending for the Department of Defense and Homeland Security.

According to The Balance, $633 billion of that budget was given to the Department of Defense (DoD).

The United States allocates more money to military spending than the next 10 countries combined. The remaining budget must cover all other domestic programs, which include funding for education, health and human services, the Department of Energy, and many more.

One of the ways to increase funding for other discretionary programs involves cuts to mandatory programs or raising taxes, both of which are considered politically controversial.

Interest on the national debt

The government must pay interest on its total outstanding debt each year. These interest payments are the fourth largest budget items in the fiscal budget. However, the intragovernmental debt is not used to calculate interest payments since this is really money the government owes itself. These are funds the government borrowed from the Social Security Trust Fund along with other federal agencies.

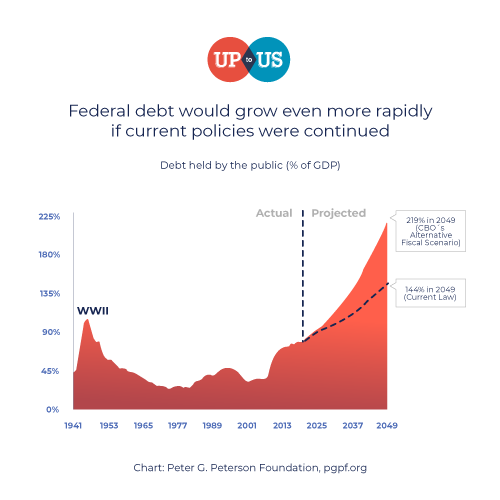

2020 deficit is projected to be $1.083 trillion, which is the largest it has ever been since 2011. Interest payments are calculated based on what the U.S. government owes foreign central banks as well as individuals and businesses.

Calculating interest on this debt is complex. These interest payments are usually one of the largest annual budget items. They can rise and fall as a percentage of the federal budget for the fiscal year. They have steadily increased since 2009, and the upsurge is expected to continue.

Take action

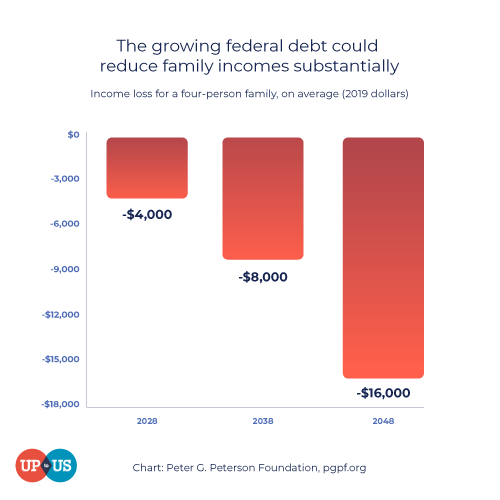

The U.S. Federal budget affects everyone. Up to Us is a program that focuses specifically on helping the students and young professionals of today take action to strengthen the financial security of the country.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. With the 2020 election coming up, it is important that we are informed on how our votes can shape our future. Check out the 2020 Election page to learn more about fiscal issues, voter registration, and how to get involved with this year's election. Sign the pledge to let local representatives know that you are concerned about the nation’s fiscal future, or get involved by learning about how you can make a difference in your own community.