The national debt is currently at $23.2 trillion and counting. This is the equivalent of $70,403 in debt per person living in the U.S. or the equivalent of Amazon CEO Jeff Bezos' net worth of $115 billion multiplied by 200.

Hard to believe, right? So, what are the main consequences of the National Debt?

-

Decreased savings and income

-

Higher interest costs

-

Lack of flexibility

-

Risks of a new crisis

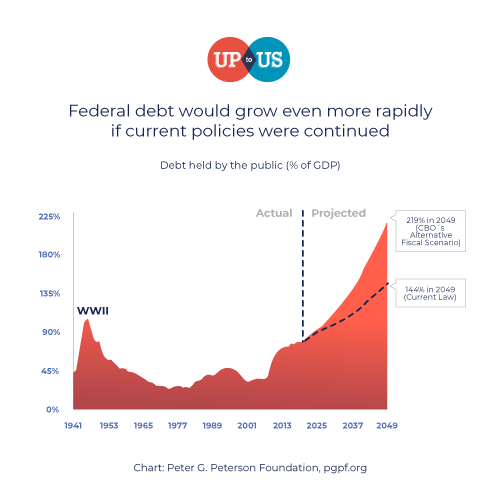

The sheer magnitude of the federal debt is hard to wrap one's mind around, and federal revenues aren't keeping up with federal borrowing. The current federal debt represents 621 percent of annual federal revenues. The ratio of the federal debt to the GDP will be around 113% in 2020 according to Trading Economics econometric models. This ratio hasn't exceeded 70 percent since World War II, a sign that federal spending has spiraled out of control.

Main consequences of National Debt

There are some extremely concerning consequences to the current level of federal debt.

Decreased savings and income

The government borrowing money means that more treasury securities are issued and compete against securities issued by the private sector. The government's need to borrow will eventually exceed the savings available, and even though more households and businesses are purchasing treasury securities, national savings will reach a low point in comparison to the size of the federal debt.

Treasury securities with high-interest rates will make saving more appealing than investing for businesses. The private sector will stop seeking investments that can generate growth due to the incentive to save. This includes the lower amount of capital available once individuals stop investing in securities offered by businesses due to treasury securities being more attractive.

This lack of investment will result in low productivity and create an environment where work produces little value and wages decrease.

Higher interest costs

Interest rates are still low, so this consequence isn't felt yet. However, the current rate of federal borrowing will eventually lead to higher interest costs. The federal funds rate will have to be increased in the near future to make up for inflation. This means that the federal deficit will grow exponentially, and reducing it will become increasingly difficult.

The only way to lower the deficit will be to implement high tax rates and reduce federal spending. This situation will result in a lower disposable income for Americans, whether high tax rates reduce their paycheck and incentive to work, or whether a future administration cuts expenses by reducing Social Security benefits.

Lack of flexibility

A small federal deficit gives an administration plenty of room to borrow at low rates in the short-term. This is a strategy that an administration might have to use in case of a recession, natural disaster, or war.

This flexibility is reduced as the federal debt increases. We are in a situation where it would be difficult for the current administration to secure additional funding at a low rate in the short-term. This considerably limits the government's ability to prepare and respond to an event.

During the 2008 Recession, the debt-to-GDP ratio was under 40 percent. The government was able to secure additional funding to make up for reduced tax revenues and increase spending. This type of response would be more difficult to implement with the current debt-to-GDP ratio.

Risks of a new crisis

The current borrowing rate will eventually create a situation where it will become increasingly difficult for the administration to secure more funds. Interest rates will go up, which means the pace at which the federal is growing will accelerate.

This is a cycle that can't be sustained, which means a major economic correction will have to happen. Possible scenarios include the U.S. debt being discounted, other countries no longer buying the U.S. debt, or the stock market performing poorly due to a loss of confidence in federal fiscal policies. The crisis could also take the form of a high inflation rate or devalued dollar.

It is unclear where the tipping point is since the current rate of government borrowing hasn't been matched in recent history. Balancing the budget doesn't seem to be a priority for the current administration, but you can make a difference by drawing attention to this issue and advocating for new spending policies.

Check out our charts and learn more about our fiscal challenges in our blog “7 U.S. National Debt Charts that Explain our Fiscal Challenges: Debt by Year and More“

Take Action!

Visit ItsUpToUs.org to find out how you can increase awareness for the growing federal debt and other issues that will affect our future. You can also stay civically engaged by checking out this cool book list. What are you waiting for? There are many ways to stay civically engaged.